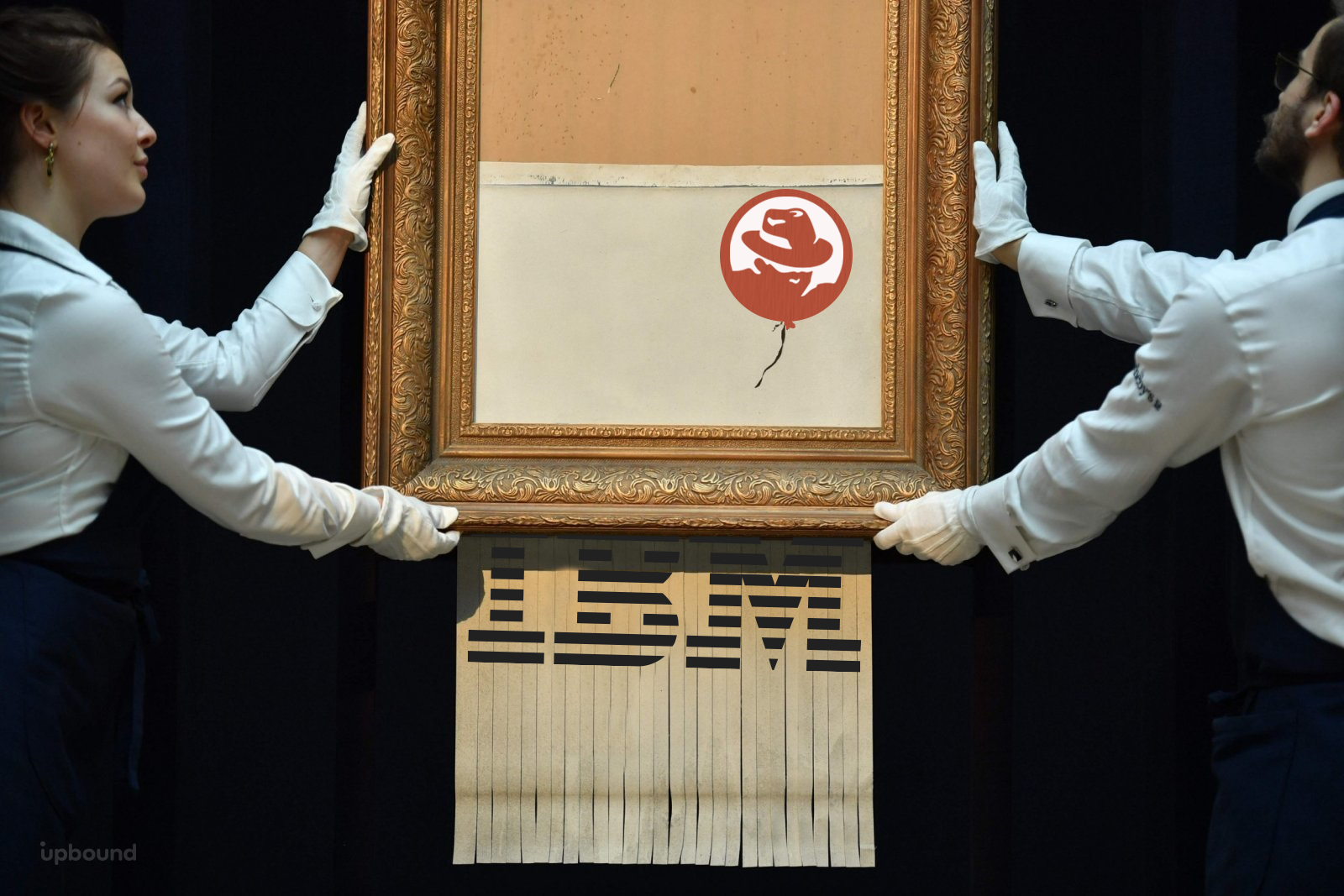

In a surprise move, IBM announced that they are going to acquire Red Hat. At $34B, this is one of the largest software acquisitions in history. This blog post walks through some of the implications of this acquisition on Commercial Open Source Software (OSS) and Cloud Computing.

Red Hat – The King of Commercial OSS

Red Hat has clearly been the dominant force in the Commercial OSS business. While Red Hat offers commercial products they typically have little in the way of commercial features beyond what readily available in Open Source.

Instead, Red Hat makes their money by selling contracts for support and professional services. As open source has become the default for IT, Red Hat takes advantage of the complexity of OSS and by offering a complete range of OSS software from kernels to platform software like OpenStack and OpenShift. They have became synonymous with enterprise-grade OSS and Commercial OSS.

Red Hat created a business out of managing OSS complexity by selling contracts for support and professional services.

Red Hat engineers follow an open development model working on public source repositories and following open source governance models. Many of the Red Hat engineers I’ve interacted with take pride in not working on commercial features, and instead spending their entire day on Open Source. It’s no wonder Red Hat is considered the mecca for OSS, and has developed a strong open source culture. While their engineers work on Open Source, for years Red Hat has shown that there was a viable business in selling contracts for support and professional services.

Are Cloud Offerings the only way forward for OSS?

With the IBM acquisition, it’s not clear whether Red Hat will begin a transformation from being a Software Provider to a Cloud Provider, and more importantly whether the acquisition itself signals that this transformation was needed for Red Hat to survive long term. Did Red Hat capitulate here due to the impeding pressure from the cloud?

If the market is trending to more cloud offerings and less software offerings, then the Red Hat acquisition starts to make a lot more sense. So does the acquisition of CoreOS last year. Red Hat is not a product or cloud company, and selling to IBM now is a better outcome than continuing to deal with shrinking TAM. Joining forces with IBM might just help them grow a cloud offering but there are challenges as we outline below.

Does the IBM acquisition signal the beginning of the end of traditional OSS monetizations models – subscriptions for support and services

In the last few months we’ve seen other OSS companies like Elastic talk about the importance of cloud offerings to their overall business, while cloud providers like AWS and the others continue to show the dominance of their “as-a-Service” model. We’ve also seen a number of Commercial OSS companies become more creative with licensing, like Redis and MongoDB that have changed their open source licenses recently to defend against the cloud.

The real winner today in OSS is Amazon that seems to make more money in OSS powered cloud services than most Commercial OSS companies.

From Software Provider to Cloud Provider?

If Red Hat is going to go through this transformation, there are some significant challenges that need to be overcome. Let's start with the following quote from the IBM press release:

IBM and Red Hat also will continue to build and enhance Red Hat partnerships, including those with major cloud providers, such as Amazon Web Services, Microsoft Azure, Google Cloud, Alibaba and more, in addition to the IBM Cloud. At the same time, Red Hat will benefit from IBM's hybrid cloud and enterprise IT scale in helping expand their open source technology portfolio to businesses globally.

You can’t offer multi-cloud as a value proposition when you are yourself a cloud provider 🤔

— bassam (@bassamtabbara) October 29, 2018

You can’t offer multi-cloud as a value proposition when you are yourself a cloud provider. The reason these partnerships were formed was because Red Hat was not itself a cloud provider. With the IBM acquisition things have changed, and these partnerships are likely to change too.

Red Hat has recently been pushing multi-cloud and cloud-neutrality in its software offerings. OpenShift for example, ran on multiple platforms and environments and promised an integrated experience across them. With the acquisition, will IBM push OpenShift closer to its own cloud offering?

Will IBM prioritize cloud revenue or software revenue?

This dilemma is going to be visited and revisited in every product decision over the next few years.

A Clash of Cultures?

Red Hat has truly been the place where Open Source engineers thrive, and Red Hat's business model was very compatible with their culture. The more great work Red Hat engineers did in the open, the more Red Hat could sell contracts for support and professional services to enterprises that want to use it.

If Red Hat was to become a cloud provider, there is likely a need for a shift in culture. While IBM is friendly to open source, if the business becomes selling compute hours on IBM's cloud, there are likely to be more commercial features and offerings. In other words, more products than just projects, and more of a focus on operations and less on support and professional services.

This also means more work in private source repositories, forks, and downstream features. Just look at Amazon, Google and Microsoft as an example. Even Google which is known for being more open, has a lot of offerings that are closed source. For Red Hat, this is likely to cause a major revolt from their engineers and is a significant cultural change.

Red Hat’s strong Open Source culture is likely it’s weakness as a future Cloud Provider

How will IBM manage this? Keeping Red Hat as a distinct division is not going to last long if IBM is going to get the return it wants on this investment. I wonder if there is going to be an exodus of talent from Red Hat (reminder Upbound is hiring).

Conclusion

The IBM acquisition looks like a clear signal that the cloud has won, and that traditional support contracts will be replaced with cloud offerings. Red Hat's capitulation here is an important lesson for Commercial OSS companies.

Subscribe to the Upbound Newsletter